Calculating futa and suta

Heres how an employer in Texas would calculate SUTA. Both FUTA and SUTA calculate as follows.

Suta And Futa Calculations Pdf Payroll Tax United States Economic Policy

MIN ROUND B6B12 MAX 0 ROUND B3-SUM A7A7 2 Note that 7700139 is 10703 but the statutory limit is 10700 rounded to the dollar.

. The FUTA tax rate protection for 2021 is 6 as per the IRS standards. The states SUTA wage base is 7000 per. The FUTA is calculated on the first 700000 the employee earns minus deductions except 401k multiplied by 60.

If the pay code is. FUTA applies to the first 7000 you paid to each employee as wages during the year. About Press Copyright Contact us Creators Advertise Developers Terms Privacy Policy Safety How YouTube works Test new features Press Copyright Contact us Creators.

How is Ma SUTA calculated. Each state has a range of SUTA tax rates ranging from 065 to 68. The company will also be.

Multiply the percentage of required SUTA tax by the employees gross wages including all tips. FUTA Tax Rates and Taxable Wage Base Limit for 2022. You will hear my voice.

Heres a breakdown of how to calculate your quarterly FUTA liability in this scenario. SUTA otherwise known as the State Unemployment Tax Act was created in parallel with the Federal Unemployment Tax Act FUTA in 1939 to help reinvigorate the US. If you have one or more.

Employers in California are subject to a SUTA rate between 15 and 62 and new non-construction businesses pay 34. The system looks at each transaction in the Payroll Transaction History table UPR30300 that are subject to FUTA. To find the SUTA amount owed multiply your companys tax rate by the taxable wage base of all your employees.

52 rows SUTA tax rates will vary for each state. However Virgin island employers must pay 24 to the government since this territory owes the US. The way I interpret Topic 759 from IRS regarding FUTA tax is that only those employees who paid state unemployment tax would be subject to the 54 credit on their.

Open the Excel spreadsheet named FUTA and SUTA before you start this video. The FUTA tax rate is a flat 6 but is reduced to just 06 if its paid on time. Calculate 6 of the first 7000 of each employees annual income.

Take the following steps to apply for a SUTA account though the. Here is the scenario. Your FUTA tax liability after the credit will be 06 of the first 7000 each employee earns.

Therefore the companys annual FUTA tax will be 006 x 7000 x 10 4200. This first 7000 is often referred to as the federal or FUTA. The FUTA tax rate is 60.

The employer will be required to submit 4200 in FUTA taxes to the IRS. Employee 3 has 37100 in eligible FUTA wages but FUTA applies only to the first. Once the video starts click on the open spreadsheet.

To start paying SUTA tax you need to set up an unemployment insurance tax account through your state. The FUTA tax liability is based on 17600 of employee earnings 4900 5700 7000. The FUTA tax applies to the first 7000 of.

Employers will receive an assessment or tax rate for. FUTA calculation steps Add up gross wages or salary for each of your employees. Calculate the amount of SUTA tax for the employee.

Futa Suta Workers Compensation Financial Accounting Youtube

Math For Business And Applications Ch 9 Payroll Fica Futa Suta Youtube

Chapter 9 Payroll Mcgraw Hill Irwin Ppt Download

Futa Suta Unemployment Tax Rates Procare Support

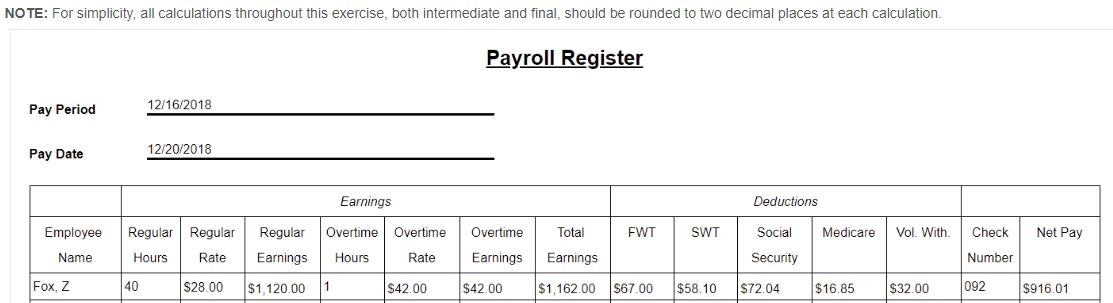

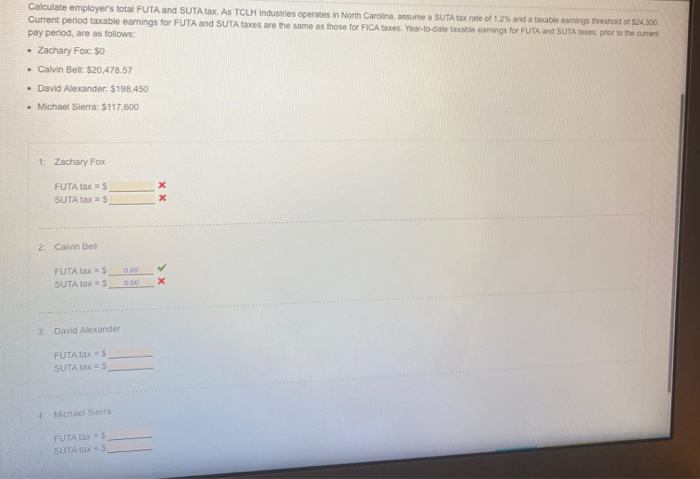

Solved Calculate Employer S Total Futa And Suta Tax As Tclh Chegg Com

How To Calculate Payroll Taxes Futa Sui And More Surepayroll

Formulate If Statement To Calculate Futa Wages Microsoft Community

How To Calculate Unemployment Tax Futa Dummies

What Is Futa Basics And Examples Of Futa In 2022 Quickbooks

Calculating Futa And Suta Youtube

Futa Tax Overview How It Works How To Calculate

Calculate Employer S Total Futa And Suta Tax As Tclh Chegg Com

Calculate Employer S Total Futa And Suta Tax As Tclh Chegg Com

Calculating Suta Tax Youtube

Federal Unemployment Tax Act Calculation Futa Payroll Tax Calculations Futa Youtube

Solved Calculate Employer S Total Futa And Suta Tax As Tclh Chegg Com

Pt 3 7 Ps 7 Federal Unemployment Tax Who Pays Futa Exempt Wages Exempt Employment Futa Tax Rate Wage Base Depositing Reporting Futa Ppt Download